The US and world stock and bond markets are in a period of dramatic uncertainty. Economic contraction and recovery due to COVID-19 and the US election are driving investor expectations and sentiment.

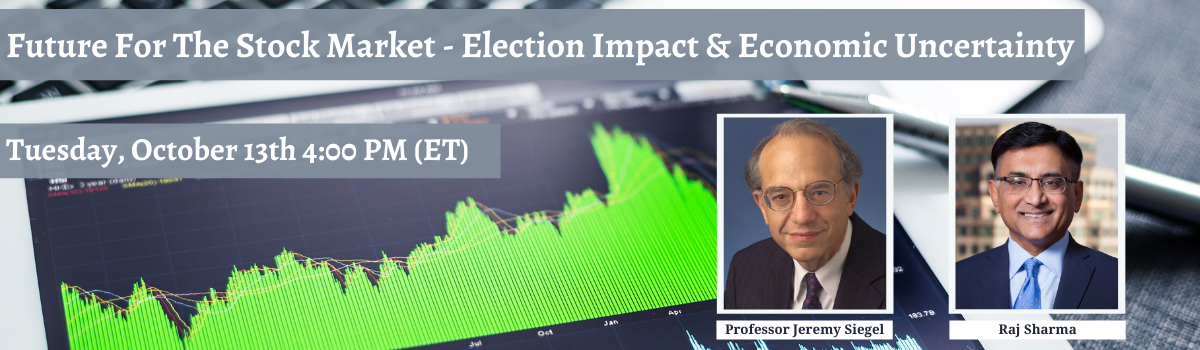

Join alumni from Harvard Business School and the Wharton School at the University of Pennsylvania for an important and engaging discussion with Prof. Jeremy Siegel. Dr. Siegel is on the Wharton faculty and is a leading expert on the stock market. He will share his views on the outlook for the market and the likely impact of the election results and the economic recovery.

Raj Sharma, Head of the Sharma Group at Merrill Lynch, will lead the discussion with Prof. Siegel.

Topics to be covered include:

- Is the stock market disconnected from the economy? Economic fundamentals are weak but the market keeps making new highs.

- How do you expect the US election outcome to impact the stock market?

- Is the Fed creating an asset bubble through its expansionary monetary policy?

- How should investors think about asset allocation? The traditional 60/40 portfolio appears to be outdated in view of extremely low bond rates.

- A few stocks ( FANG) appear to be driving the majority of market returns? Will this lead to an unsustainable asset bubble and a crash similar to the 2000-2002 internet bubble?

- What is your definition of a safe asset in today’s environment?

Raj Sharma will lead the discussion of these important topics for 60 minutes followed by a 30 minute Q&A period open to everyone on the program.

When:

Tuesday, October 13, 2020

4:00 PM ET - 5:30 PM ET

Cost:

$10 per person

Click here to register. Please note that all registrations will be through the HBS Association of Boston.